02Aug

Enabling hybrid financial instruments to leverage regenerative capital investment in cultural heritage adaptive reuse

Cultural heritage adaptive reuse activities embody circular economy dimensions, which engender social, cultural, environmental and economic regeneration, within the global value chain. Such activities, including adaptive reuse and energy retrofit of built heritage structures, protection of natural eco-systems and cultivation of socio-cultural community enterprise endeavours, involve long-term investment horizons necessitating the integration of sustainable funding mechanisms. In order to achieve exponential human prosperity, the cultural heritage sustainable finance movement must re-evaluate investment leverage strategies including value creation models, the design of hybrid circular financial instruments, collaborative social enterprise investment structures and evolving impact performance and benchmarking metrics to inform decision making. CLIC has developed a panoptic circular financial toolkit of complementary financial and non-financial instruments designed to leverage capital investment and engender collaborative partnerships to encourage regenerative capital flow to cultural heritage social enterprise ventures.

Designing Circular Hybrid Financial Instruments within Virtuous Investment Circles

Within a circular economy, capital allocation investment decisions can no longer revolve around pure profit motivation and the blinkered self-interest of investors. The rise of combined market driven and impact focused venture capital investment initiatives, combined with the rise in citizen-led co-giving and co-investment crowd funding platforms, signals an appetite for long-term sustainable investment opportunities in the marketplace in parallel with an eagerness among proactive communities to coalesce in order to safeguard cultural heritage resources. However, a critical investment bottleneck still exists in creating sustainable investment leverage for many Paris-aligned or SDG-aligned investment opportunities, whether regional, community or place led, particularly in disadvantaged urban and depopulated rural locations. Thus, work still remains to cultivate ‘connective networking Infrastructures’ to foster tactical relationships between ‘grassroot’ cultural heritage initiatives and cash-rich investment markets.

Regenerative Capital by Design

Designing sustainable and circular regenerative investment strategies is central to achieving transformational socio-economic systems change to enhance capital leverage for cultural heritage adaptive reuse. The concept of ‘Regenerative Capital’ relies on an investment rationale that nurtures Responsible, Resilient and Regenerative transitionary activities, additional to the triple bottom line, in the real economy (Elkington 2020). This strategy entails the application of nature’s laws and patterns of systemic health, self-organization, self-renewal and regenerative vitality to socio-economic systems (Fullerton 2015).

Circular ‘Regenerative’ funding strategies seek to strengthen the financial sustainability and resilience of final recipients. Four bodies of knowledge are pivotal to the choice and design of financial instruments within a circular funding strategy: Tool knowledge; Circular design knowledge; Stakeholder knowledge and Impact knowledge.

Real transformation in the form of ‘Regenerative Capital’ for cultural heritage adaptive reuse will require a constant flow of mainstream investment funds (from equity investors, pension funds, insurance companies), along-side less risk averse philanthropic and social enterprise investment funds, to stream directly to ‘real world’ community and regional level social enterprise activities (as opposed to safe secondary investment markets). For this reason, understanding core investment motivations and the benefits of cross fertilization of knowledge, skills and capacity within collaborative partnership models is the key to designing innovative hybrid financial instruments to safeguard complex cultural heritage values within virtuous investment circles.

Circular Toolkit of Hybrid Financial Instruments & Investment Leverage Enablers

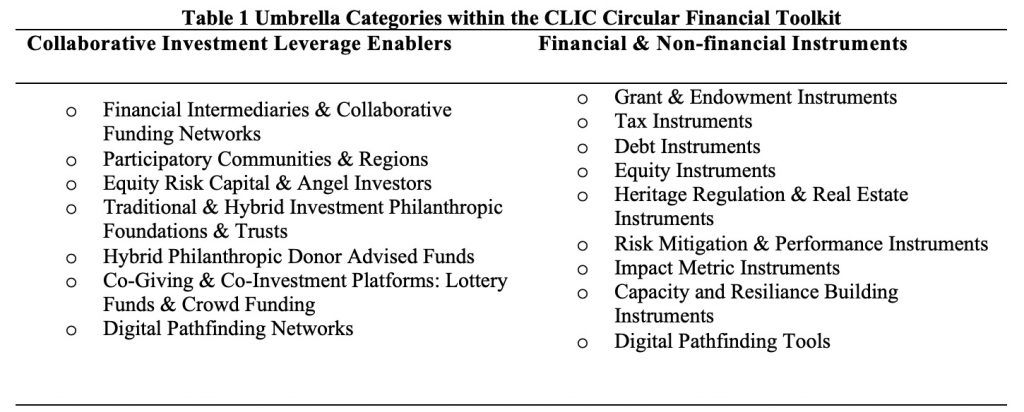

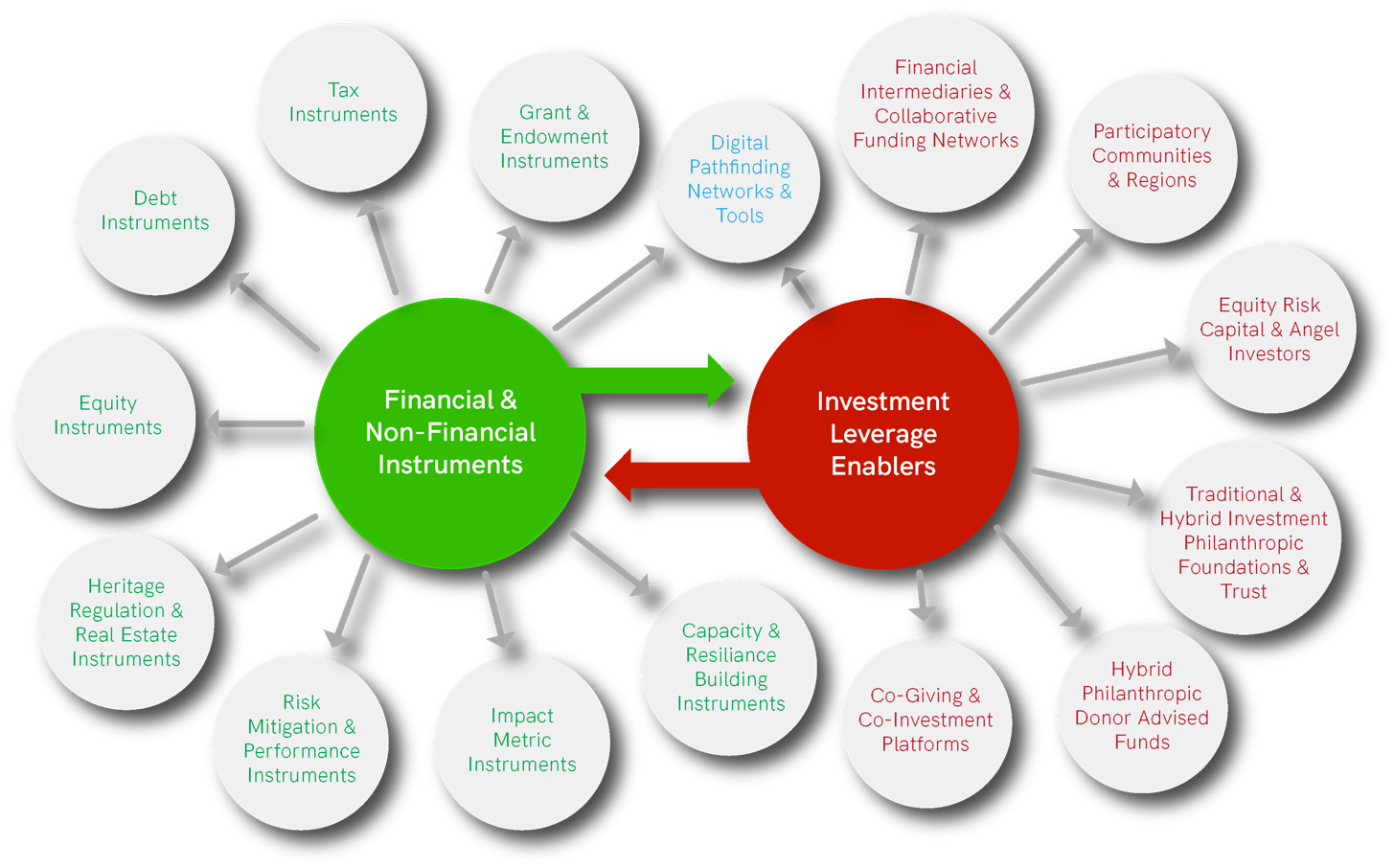

In choosing, designing and implementing financial instruments, it helps to think systematically about how to create an enabling environment with regard to identified drivers and barriers to investment. The aid this process, the CLIC Circular Financial Toolkit provides ‘umbrella’ categories’ of complementary financial and non-financial instruments, designed to leverage capital investment and encourage collaborative partnerships incorporating community participation. Table 1 identifies the umbrella categories of investment leverage enablers and financial and non-financial instruments within the toolkit.

Depending on political and economic context, decisions regarding the strategic blending of complementary financial instruments and pooling to create multilateral partnership structures will differ from place-to-place or community-to-community. Within a collaborative fund structure, rational capital allocation investment decisions revolve around each investor’s return expectations, return time frame, appetite for risk and defined social and environmental impact goals. The final design of blended hybrid financial instruments at project, fund or portfolio level must be tailored to the specific needs of final recipients. This preference is ratified by evolving impact metrics that support the ethos that well designed hybrid financial instruments have the capacity to recycle financial capital for the perpetual benefit of socio-cultural and environmental capital. The use of risk mitigation, capacity and resilience building instruments, aligned with the development of digital network pathfinding tools, is vital to bridging the connective infrastructure gap to open up micro investment leverage opportunities for underserved communities and regions.

Transforming Human Capital

The transition to a more sustainable and circular future economy will result in inevitable disruption in the financial ecosystem leading to both value creation (Regenerative Capital) and value destruction (Degenerative Capital) in different sectors of the economy, although the extent of this is not yet known. Capital markets must collectively embrace the concept of ‘Stakeholder Capital’ on the basis that if risks and potential losses are shared by society, then any resultant rewards must also be shared with society. The challenge will be to design hybrid financial instruments that actively contribute to combined multiple objectives set out in the Sustainable Development Goals (SDGs), the European Green Deal and the EU Taxonomy sustainable performance thresholds and thereby gain greater competitive recognition within financial markets.